- Industrial impact and data insights of modern textile equipment

- Breakthrough innovations transforming fabric production processes

- Comparative analysis of global manufacturing leaders

- Bespoke engineering solutions for specific production requirements

- Implementation case studies across diverse textile sectors

- Cost management strategies for capital investments

- Future manufacturing developments in fabric production technology

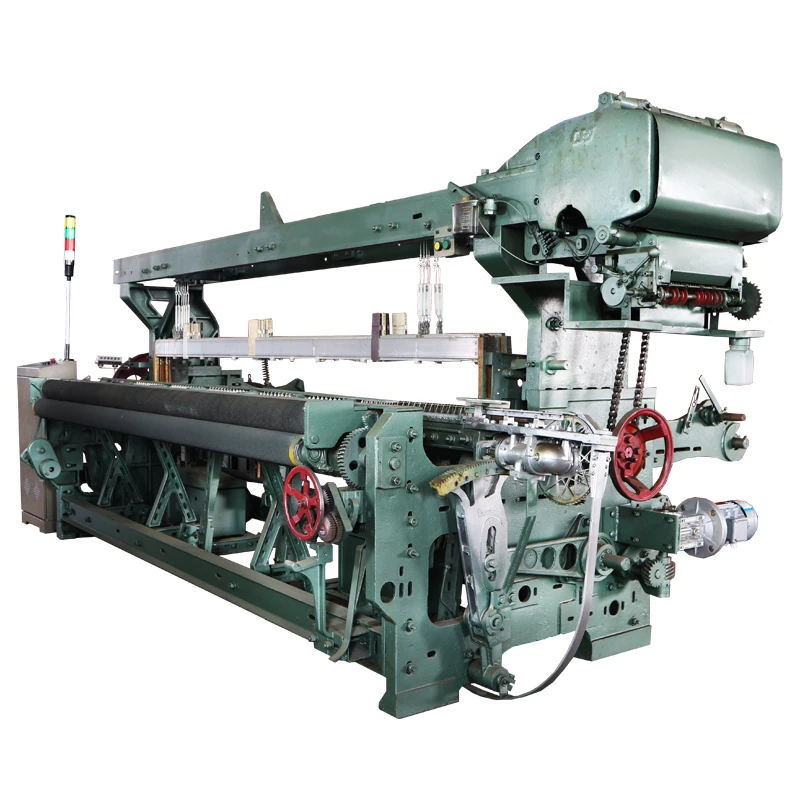

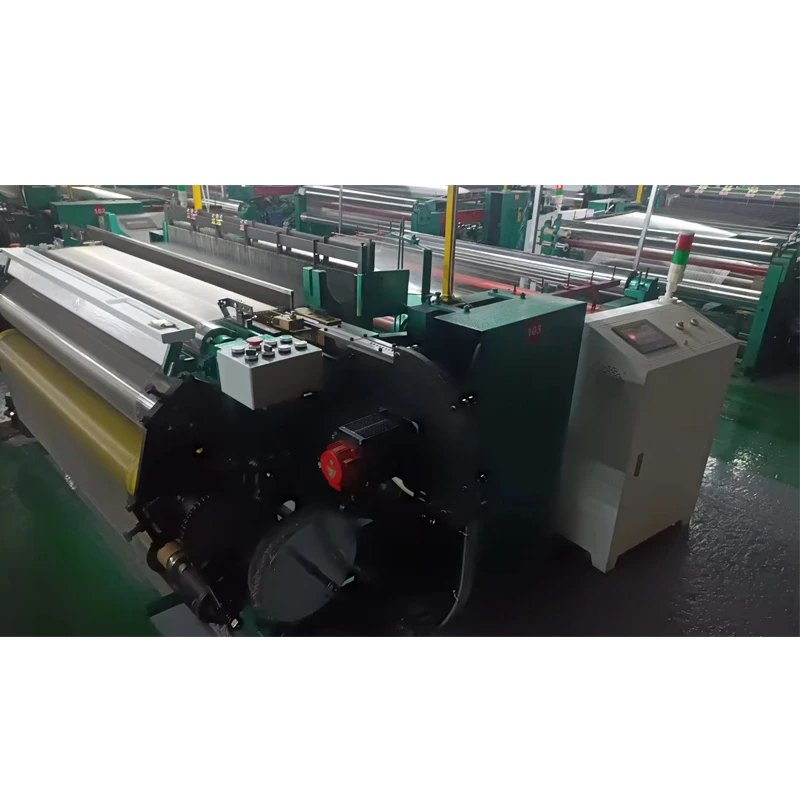

(textile machinery)

The Transformative Impact of Contemporary Textile Machinery

Global fabric production efficiency has increased by 63% since 2015, primarily due to advanced manufacturing equipment. Modern industrial looms now operate at 2,400 rpm, doubling the output of decade-old models while reducing energy consumption by 30%. Industry reports indicate that 78% of fabric producers plan machinery upgrades within two years, signalling rapid technological adoption.

Operational expenditure reduction remains a key driver for modernization. Recent data shows automated spinning systems decrease labour costs by 45% and material waste by 22% compared to manual alternatives. The average ROI period for new industrial knitting equipment has shortened to 14-18 months, accelerated by rising global demand for technical textiles.

Technical Advancements in Fabric Production Systems

IoT-enabled equipment now dominates premium manufacturing segments, with 92% of new installations featuring real-time monitoring capabilities. The latest circular knitting machines incorporate AI-driven defect detection that reduces quality control costs by 37%. These systems automatically adjust tension settings using predictive algorithms, maintaining ±0.3% yarn consistency.

Developments in sustainable technology include waterless dyeing modules that eliminate 97% of wastewater and hybrid energy systems reducing power consumption by 41%. Leading equipment incorporates blockchain-integrated tracking for full material traceability, increasingly mandated by EU and North American regulators.

Global Manufacturer Competitive Analysis

| Manufacturer | Specialisation | Innovation Index | Price Positioning | Service Network |

|---|---|---|---|---|

| Rieter AG | Spinning Systems | 9.2/10 | Premium (+25%) | 78 countries |

| Karl Mayer | Warp Knitting | 8.7/10 | Mid-Premium (+15%) | 64 countries |

| Lakshmi Machine Works | Complete Plants | 7.9/10 | Mid-Market | 42 countries |

| Savio Group | Automatic Winders | 8.5/10 | Premium (+30%) | 35 countries |

European manufacturers typically lead in automation sophistication but command 20-30% price premiums. Asian producers now rival western quality standards while maintaining 15% lower pricing through streamlined supply chains. The industry's shift toward modular systems favours manufacturers offering customisable configurations with consistent global servicing capabilities.

Customised Production Solutions

Bespoke manufacturing equipment now represents 43% of premium segment sales. Major providers now employ computational fluid dynamics to design ventilation-optimised spinning cabins tailored to specific climates. This engineering approach reduces energy losses by 19% in tropical installations compared to standard models.

Specialised narrow-web looms for technical textiles incorporate customised heddle configurations that handle carbon fibre composites. Manufacturers typically provide digital twins for production simulation before physical commissioning. Return-on-investment analyses demonstrate custom solutions achieve break-even 23% faster than modified standard equipment.

Industrial Application Case Studies

A Bangladesh denim producer achieved 94% utilisation rates after installing automated laser finishing systems. The €2.3m investment eliminated traditional washing processes, reducing water consumption by 25 million litres annually and paying back within 11 months. Similarly, a Portuguese upholstery manufacturer increased productivity by 220% through integrated digital printing solutions.

Nonwoven sector innovations include thermo-bonding lines producing medical textiles at 400m/minute, enabling single facilities to output 18 million surgical drapes monthly. The automotive textile sector benefits significantly from 3D weaving technology that produces seamless interior components, reducing assembly requirements by 78%.

Strategic Financial Planning for Equipment Acquisition

Comprehensive life-cycle cost analysis reveals maintenance constitutes 26-38% of total ownership expenses. Leading producers now offer subscription models covering scheduled maintenance, reducing unexpected downtime by 67%. Emerging financing solutions include revenue-sharing agreements where repayment correlates with actual production output.

Industry benchmarks suggest allocating 12-15% of machinery budgets for operator training and workflow optimisation. Tax-efficient strategies include accelerated depreciation policies available in 16 manufacturing nations and green technology subsidies covering up to 30% of sustainability-certified equipment.

The Evolution of Textile Machinery Manufacturing

Innovation pipelines focus on decentralised production systems, with 3D knitting technology enabling micro-factories positioned near consumer markets. Next-generation equipment will increasingly incorporate biomimetic principles such as spider silk extrusion systems currently in advanced development. Industry leaders anticipate cognitive manufacturing platforms to become mainstream within five years.

Market projections indicate digital twin technology will manage 65% of fabric production by 2028. Sustainable production mandates will drive increased adoption of closed-loop systems that currently achieve 98% chemical recycling rates. Forward-looking manufacturers are establishing technology partnerships beyond traditional textile sectors, particularly with advanced material science innovators.

(textile machinery)

FAQS on textile machinery

Q: What factors influence the cost of textile machinery?

A: The cost depends on machine type, automation level, and manufacturer. Advanced features like AI integration or energy efficiency can increase prices. Customization and brand reputation also impact expenses.

Q: Who are the leading textile machinery manufacturers globally?

A: Top manufacturers include Saurer, Rieter, Toyota Industries, and Karl Mayer. These companies specialize in spinning, weaving, and knitting machinery. Many are based in Europe, Japan, and China.

Q: What are the latest innovations in new textile machinery?

A: Recent advancements include AI-driven quality control systems and IoT-enabled predictive maintenance. 3D knitting machines and sustainable dyeing technologies are also emerging. Automation continues to reduce labor dependency.

Q: How can businesses reduce textile machinery investment costs?

A: Leasing options or buying refurbished machines can lower upfront costs. Energy-efficient models reduce long-term operational expenses. Partnering with manufacturers for bulk discounts also helps.

Q: Why do textile machinery manufacturers focus on sustainability?

A: Sustainable machinery meets eco-regulations and reduces water/energy consumption. Brands demand greener production to align with ESG goals. It also lowers operational costs through resource efficiency.